Last updated: July 31st, 2023 at 09:16 am

Solar energy is one of the most popular forms of renewable energy in the UK, and for good reason. Not only does it provide clean energy, but it also saves homeowners money on their energy bills. The UK government has recognized the importance of solar energy and offers a variety of government grants for solar panels and schemes to help homeowners install solar panels. In this blog, we’ll go over everything you need to know about government grants for solar panels in the UK in 2023.

Despite the energy price crises and inflation, Prime Minister Rishi Sunak has removed the 5% VAT on solar panel installation for a period of 5 years. Currently, VAT on solar panel installation is set at 0%. The government grants for solar panels in UK now presents an excellent opportunity to switch to a solar PV system.

What Solar Panel Funding is Available in UK?

The government has been actively promoting renewable energy sources for several years, and as part of their efforts, they have introduced various grant schemes to encourage people to transition to renewable energy. One of the initial steps taken was to reduce the price of solar panels, making it more accessible for the average person. While there are no traditional grants specifically for solar panels at the moment, there is one open grant called the Smart Export Guarantee for new applications.

In addition to government grants for solar panel, there are other incentives and benefits available for solar panels in the UK.

| Solar Grants | Potential Saving | Run Time |

| 0% VAT | One can save more than £1200 on solar panel installation and energy bills. | From April 1 to March 2027 |

| Energy Company Obligation (ECO4) | Partially or fully FREE solar panel possibility | From April 1 to March 2026 |

| Smart Export Guarantee | £160 per year | From 1st Jan – indefinite time |

| Feed In Tariff | 4.21p per kWh you produce & 5.99p per kWh you send to the grid | Expired in 2019 — but those registered will continue to benefit |

| Renewable Heat Incentive | Up to £3,000 | Expired on 31 March, 2022 |

| Free Solar Panel Scheme | Free solar panels (£5,000 to 10,000) | Expired in March 2019 |

Latest News – Solar Panels are Now VAT-Free Until 2027!

In recent times, Europe has experienced the highest energy prices in four decades, with inflation largely driven by rising energy costs. In an effort to assist UK households in reducing their electricity bills, the government has implemented a reduction in the VAT on solar panel installation from 5% to 0% under the government grants for solar panels UK.

According to a government report, the average household can expect to save over £1,000 in total installation costs and £320 on annual energy expenses.

It’s important to note that the VAT exemption will remain in effect until 2027, after which the rate will return to 5%. Don’t miss out on this opportunity to save money on your electricity expenses. Take advantage of it now and start enjoying the benefits of solar panel installation.

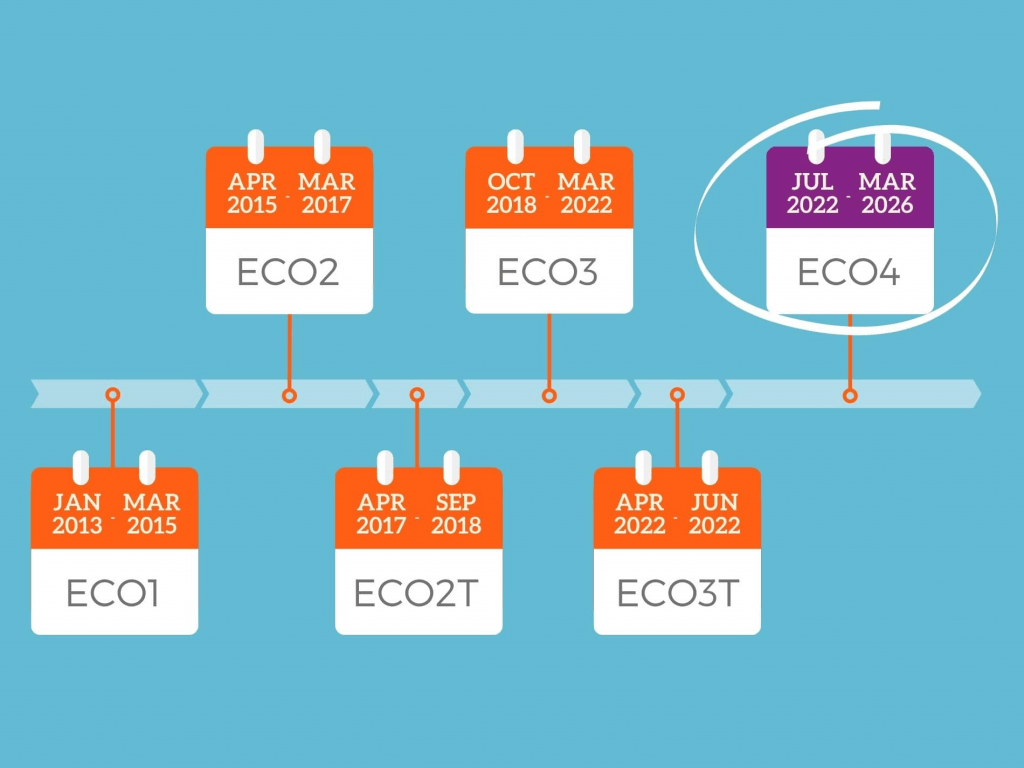

The ECO4 Scheme – Government Grants for Solar Panels

One of the most well-known government schemes for solar panels in the UK is the ECO4 scheme, which was implemented in April 2022 and will run until March 2026. The purpose of the government grants for solar panels is to improve the energy rating of UK homes and reduce carbon emissions.

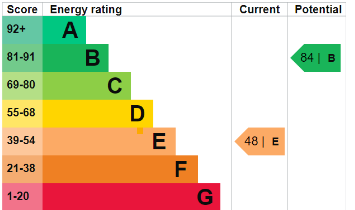

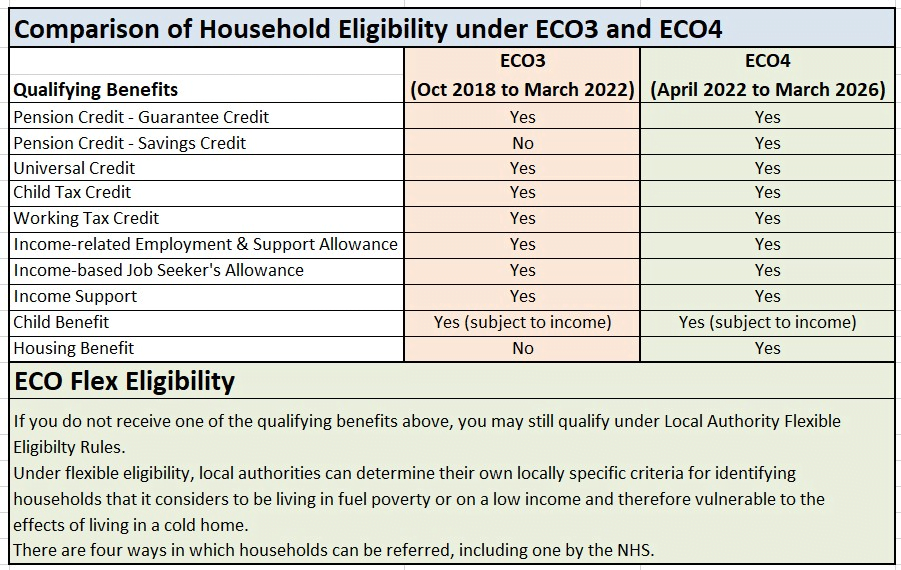

The ECO4 scheme is open to all UK homeowners, regardless of whether they own or rent their property. Eligible individuals can receive free or discounted solar panels through the scheme, which aims to assist low-income households in reducing their energy bills and carbon footprint. The eligibility criteria for the ECO4 scheme are as follows:

-

- You must be a homeowner or private tenant in the UK

-

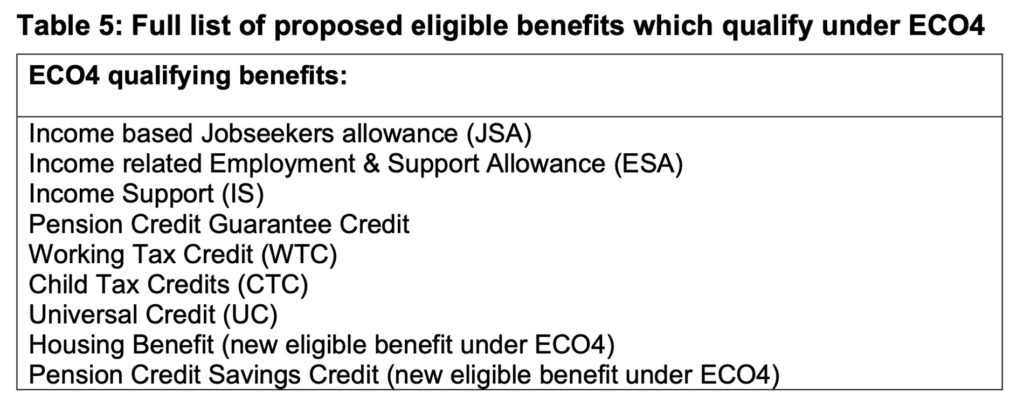

- You or someone in your household must receive certain benefits

-

- Your home must have an Energy Performance Certificate (EPC) rating of D, E, F, or G

-

- Your home must be suitable for solar panel installation

If you meet the eligibility criteria, you can apply for the ECO4 scheme through an approved installer. The installer will assess your home to determine if it’s suitable for solar panel installation and will provide you with a quote. If you decide to go ahead with the installation, the installer will handle all the paperwork and the installation process.

The amount of funding you can receive through the ECO4 scheme depends on your household income and the number of children in your household. The following table shows the maximum funding amounts for different household sizes:

One-parent households: One child – £18,000 Two children – £21,000 Three children – £24,000 Four or more children – £27,000

Two-parent households: One child – £27,500 Two children – £32,300 Three children – £37,200 Four or more children – £42,000

If you receive funding through the ECO4 scheme, you won’t have to pay anything upfront for the solar panel installation. Instead, you’ll make repayments through your energy bills over a period of time. The repayments are designed to be affordable, and you should see a reduction in your energy bills right away.

Benefits of ECO4

The ECO4 scheme offers significant benefits to low-income households in the UK by providing the opportunity to upgrade their heating systems to more efficient and eco-friendly alternatives, such as solar PV panels.

This scheme is expected to upgrade around 450,000 homes, primarily to an EPC band C rating. This means that households will benefit from reduced energy bills, with an average reduction of approximately £290 per year. For homes with the least efficient heating systems, this reduction could be as much as £1,600 annually.

Eligibility criteria

The ECO4 scheme is designed to help low-income, fuel-poor, and vulnerable households in the UK receive assistance with their heating systems. To qualify for solar PV panels, your home must meet specific requirements, including having an inefficient heating system within the D-G energy efficiency band, owning your home or living in private rented accommodation, and receiving government benefits like income support or child benefits.

For households that are not currently receiving benefits but are considered low-income, there is still an opportunity to qualify for ECO4 through the ECO4 LA Flex program. This program allows local councils to determine eligibility criteria tailored to the needs of people in their area, which may include factors like age, number of occupants, number of children, and the condition of the home. This means that more people in the UK will have access to government grants for solar panels UK.

How to Apply for ECO4 Scheme

To apply for the ECO4 scheme, contact a participating energy supplier for a telephone assessment. If you qualify, an installer will confirm the energy-efficient measure’s suitability for your home. Choosing the right solar panels is crucial for maximising savings – tailor-made panels can reduce annual energy bills in the UK by over 70%. Compare up to three tailor-made solar systems in your region for the best choice that matches your home’s specific needs and leads to maximum efficiency and savings.

Smart Export Guarantee (SEG) Scheme – Government Grants for Solar Panels UK

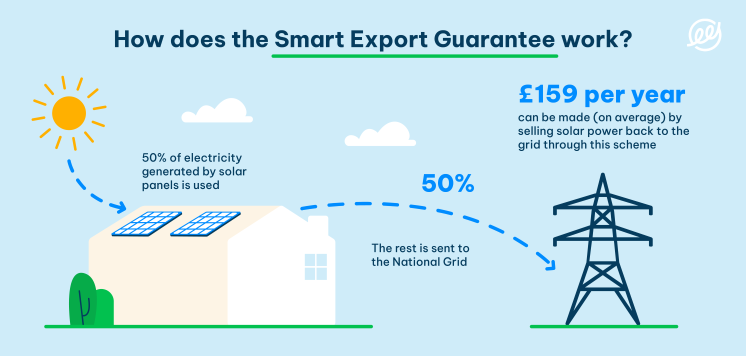

In addition to the FIT scheme, the UK government also introduced the Smart Export Guarantee (SEG) scheme in Jan 1st, 2020. This scheme requires energy suppliers with more than 150,000 customers to offer a tariff for the surplus electricity generated by small-scale low-carbon generators, including solar panel systems. This means that homeowners with solar panels can earn money by selling their surplus electricity back to the grid.

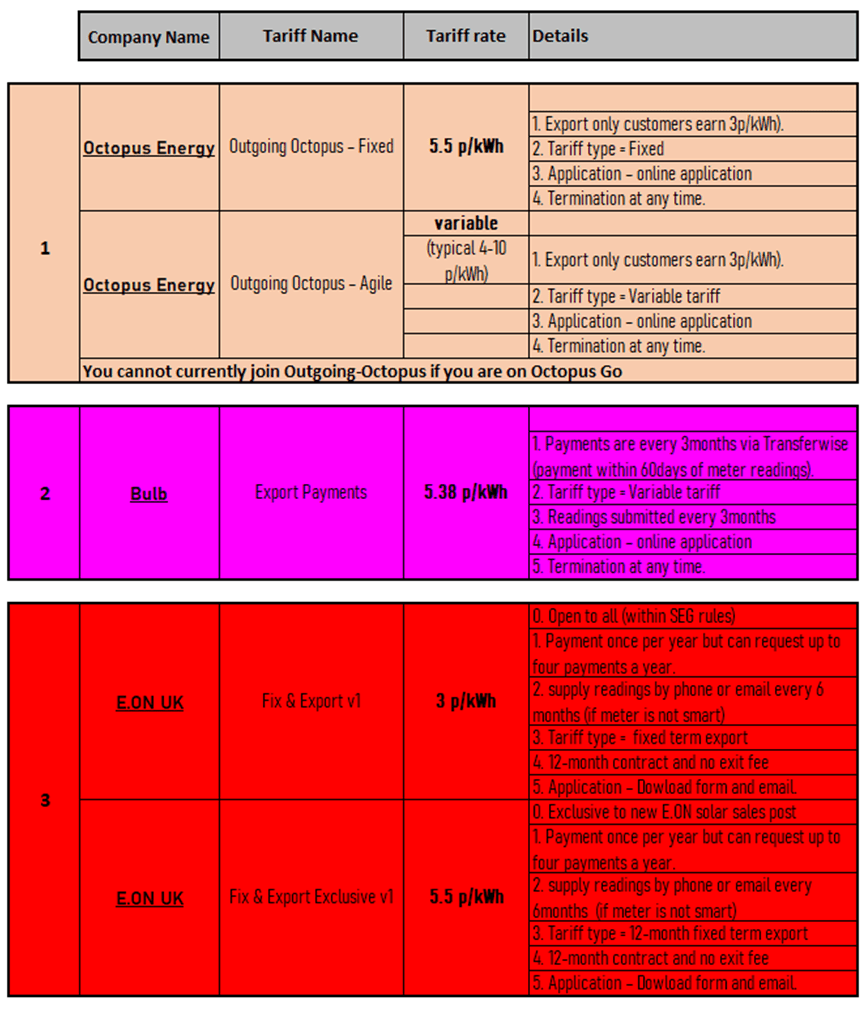

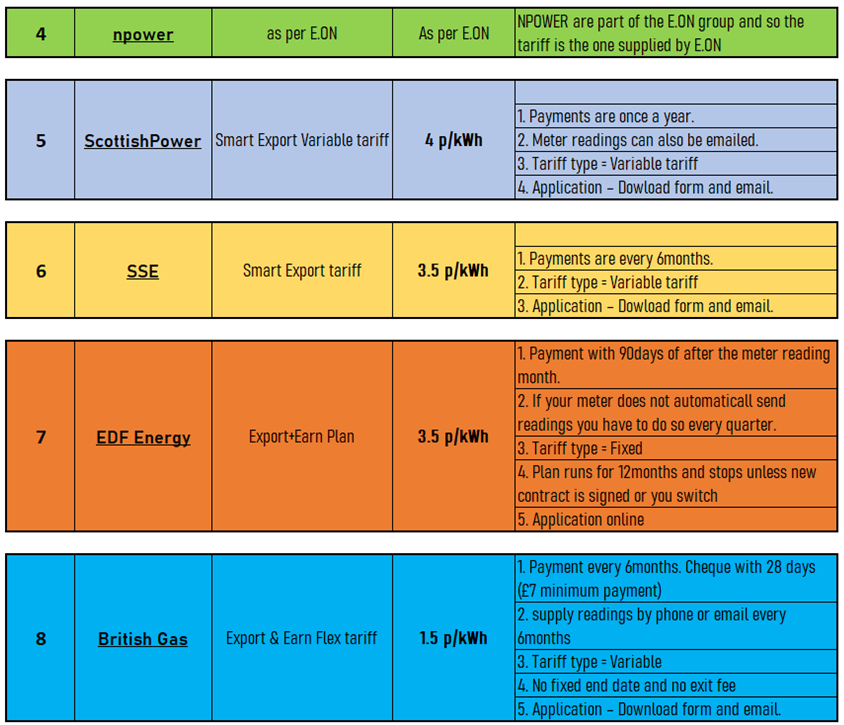

Under the SEG scheme, energy suppliers set their own tariffs, so it’s important to shop around to find the best deal. Tariffs can be fixed or variable, and some suppliers may offer export payments in addition to the standard tariff. It’s important to note that the SEG scheme only applies to new solar panel installations and does not provide any funding for the installation itself.

The SEG scheme is expiry date is not out yet. It’s important to note that while the SEG scheme provides a way for homeowners to earn money from their solar panels, the amount they can earn will depend on a number of factors, including the size of their solar panel system, the amount of surplus electricity they generate, and the tariff rate offered by their energy supplier.

Advantages of Smart Export Guarantee

The Smart Export Guarantee (SEG) provides benefits to solar panel owners by allowing them to shop around for the best price per kWh for exporting their excess energy. SEG Licensees offer rates between 1p and 7.5p per kWh, and solar panel owners can choose any licensee, regardless of their electricity supplier. This flexibility enables them to secure the best deal for their exported energy. Based on a rate of 7.5p per kWh, a typical three-bedroom home with a 3.5 kWp solar panel installation can earn £112 per year under SEG.

Smart Export Guarantee (SEG) Tariff Comparison

Eligibility Criteria

To be eligible for the SEG, homeowners must have solar panels with a capacity of up to 5MW and a smart meter to measure exports. Certain energy suppliers may offer unique rates for energy exported from particular solar battery storage systems.

How you can apply for Smart Export Guarantee

To apply for Smart Export Guarantee, you need to find an SEG Licensee and apply directly to them. All eligible generators can receive an SEG tariff. Make sure to have an energy-efficient panel tailored to your home’s needs before applying for SEG tariffs.

VAT Reduction – Government Grants for Solar Panels

Another way that the UK government has supported the installation of solar panels is by reducing the VAT rate on renewable energy products and installations. In April 1st, 2022, the government announced that the VAT rate on solar panel installations would be reduced from 20% to 5%, making it more affordable for homeowners to install solar panels.

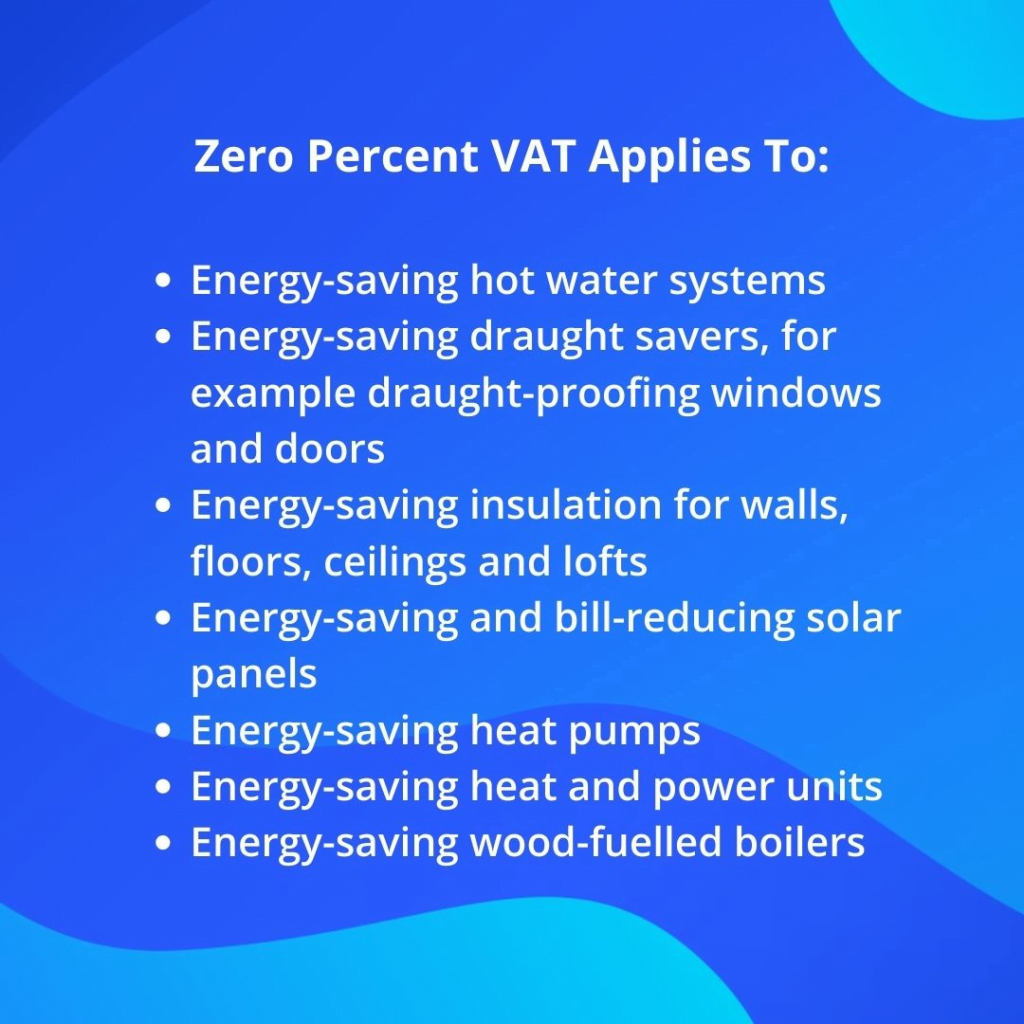

This VAT reduction applies to all solar panel installations on residential properties, regardless of the size of the system or the income of the homeowner. It also applies to all associated products and services, including batteries, inverters, and installation costs.

The reduced VAT rate on solar panel installations is expected to make a significant difference in the affordability of solar panels for homeowners, reducing the upfront cost and increasing the potential return on investment. This reduction also brings the VAT rate on solar panels in line with the VAT rate on energy bills, further encouraging the adoption of renewable energy.

It’s important to note that while the VAT reduction on solar panel installations is a welcome change, it only applies to the installation itself and not to ongoing maintenance or repair costs. Homeowners should also be aware that the VAT reduction may not be applied automatically and should check with their solar panel installer to ensure that they are receiving the reduced rate.

Advantages of 0% VAT

0% VAT on renewables, such as solar panels, heat pumps, biomass boilers, insulation, and other energy-saving materials, can result in significant savings for households. Scrapping the previous 5% VAT will see typical families with rooftop solar panels save over £1,000 on installation and £300 annually on their energy bills.

Eligibility Criteria

Eligibility for the 0% VAT rate is based on specific requirements that must be met. The installation and product must be done together, and the primary work must be for energy-saving materials. The government’s website provides full details and the previous eligibility criteria no longer apply. Other goods and services, such as insulation, can also be installed at the same time.

How you can apply for 0% VAT

The 0% VAT will be applied automatically by the installer if the installation and energy-saving material are eligible, so no application process is required.

Recently Expired: The Green Homes Grant – Government Grants for Solar Panels

Another government scheme that homeowners can take advantage of is the Green Homes Grant. This scheme was launched in 2020 and provides funding for a variety of energy-saving home improvements, including solar panel installation. The Green Homes Grant is open to all UK homeowners and covers up to two-thirds of the cost of eligible home improvements, up to a maximum of £5,000 per household. Low-income households can receive up to 100% of the cost of eligible home improvements, up to a maximum of £10,000.

The eligibility criteria for the Green Homes Grant include:

-

- You must be a homeowner or private tenant in the UK

-

- Your home must be built before 2011

-

- Your home must have an Energy Performance Certificate (EPC) rating of D, E, F, or G

To apply for the Green Homes Grant, you’ll need to find a registered installer and obtain a quote for the solar panel installation. Once you’ve received the quote, you can apply for the grant through the Simple Energy Advice website. If your application is approved, you’ll receive the grant funding, and the installer will handle the installation process.

Recently Expired: The Feed-in Tariff Scheme – Government Grants for Solar Panels

In addition to the ECO4 and Green Homes Grant schemes, homeowners can also take advantage of the Feed-in Tariff (FIT) scheme. This scheme pays homeowners for the renewable electricity they generate through their solar panels. The FIT scheme was closed to new applicants in 2019, but if you installed solar panels before that time, you may still be eligible to receive payments.

Under the FIT scheme, homeowners receive two types of payments:

-

- Generation tariff: A set rate paid for each unit of electricity you generate. This rate depends on the size of your solar panel system and when it was installed.

-

- Export tariff: A set rate paid for each unit of surplus electricity you export back to the grid.

The amount you can earn through the FIT scheme depends on the size of your solar panel system, the amount of electricity it generates, and the rates set by the government. FIT payments are tax-free and are made quarterly over a period of 20 years.

Other Recently Expired: Government Grants for Solar Panels

In addition to the ECO4 scheme, Green Homes Grant, and FIT scheme, there are other grants and schemes that homeowners can take advantage of to help with the cost of solar panel installation. These include:

-

- Renewable Heat Incentive (RHI): This scheme pays homeowners for the renewable heat they generate through technologies such as solar thermal panels. The RHI is open to both homeowners and businesses and pays out over a period of 7 years.

-

- Local authority schemes: Some local authorities offer grants or loans to homeowners for solar panel installation. Check with your local authority to see if they offer any such schemes.

-

- Energy Company Obligation (ECO): This scheme is similar to the ECO4 scheme and provides funding for energy-saving home improvements. Check with your energy supplier to see if they offer any ECO schemes.

Solar Panels Funding is Legitimate, Right?

Yes, UK solar panel funding is legitimate. You can recoup most of the installation costs of solar panels and other energy-saving measures through ECO4 if you meet the eligibility criteria. You can also earn money by generating extra electricity through the Smart Export Guarantee.

MAK Energy Ltd reviews solar panel funding regularly and provides updated information. It’s important to choose the right panel for your home, and MAK Energy Ltd can help you by providing tailor-made solutions available near you. For further information on energy government grants for solar panels, you can visit the government’s website. If you decide to invest in solar power or other clean energy sources, MAK Energy Ltd can help you receive free, non-binding quotes for solar panel, solar thermal & their installation, saving you time and effort.

Conclusion

Solar energy is an excellent way to reduce your carbon footprint and save money on your energy bills. The UK government offers a variety of government grants for solar panels and schemes to help homeowners install solar panels, including the ECO4 scheme, Smart Export Guarantee(SEG) Scheme, Green Homes Grant, and FIT scheme. If you’re considering installing solar panels, be sure to check if you’re eligible for any of these schemes to help with the cost.